Google May Have to Say Goodbye to Chrome

- Google Chrome might not stay in Google’s hands for much longer—here’s why.

- A $20 billion browser sale? The DOJ just turned up the heat on Big Tech.

- Google’s search monopoly isn’t the only target—AI and Android are in the mix too.

Forced Sale: Google Chrome Could Be Valued at $20 Billion

Alphabet Inc.'s Chrome browser, the world’s most popular web browser, is at the center of a high-stakes antitrust case. The U.S. Department of Justice (DOJ) plans to ask a federal judge to compel Google to divest Chrome, potentially fetching a valuation of up to $20 billion. This proposal follows an August ruling by Judge Amit Mehta that Google has illegally maintained a monopoly in online search.

If approved, the move could mark one of the most significant interventions in Big Tech history, reshaping Google’s dominance in the tech landscape. Photo via Google // Google Chrome, the world’s most popular browser, now at the center of a $20 billion antitrust proposal.

Photo via Google // Google Chrome, the world’s most popular browser, now at the center of a $20 billion antitrust proposal.

Key Developments

1. Targeting Chrome and Android

DOJ lawyers intend to present measures designed to limit Google's control over the search and advertising markets. This includes:

- Forcing the sale of Chrome, which holds 64.61% of the global browser market share (Similarweb, October 2024).

- Unbundling Android from Google Search and the Play Store.

- Restricting exclusive default contracts that helped Google dominate 90% of the global search market (Statcounter, October 2024).

Photo via Tom's Guide // It's not just Google Chrome: Google’s Android operating system is also under scrutiny in the DOJ’s proposed remedies.

Photo via Tom's Guide // It's not just Google Chrome: Google’s Android operating system is also under scrutiny in the DOJ’s proposed remedies.

2. AI and Data Transparency

Officials are expected to recommend changes that would:

- Prevent Google from using web content for AI training without explicit consent.

- Increase transparency for advertisers, giving them more control over ad placement.

3. Broader Industry Impact

Competitors such as Safari, Firefox, and Brave stand to benefit if Chrome is spun off. Damian Rollison, an industry expert, noted, “A market without Chrome propped up by Google could provide rivals with a fairer playing field.”

Google Pushes Back (Of Course)

Google has strongly opposed the DOJ’s proposals. Lee-Anne Mulholland, Google’s Vice President of Regulatory Affairs, called the recommendations a “radical agenda,” arguing they would harm consumers, developers, and technological innovation. She emphasized, “The government putting its thumb on the scale in these ways would harm consumers, developers, and American technological leadership at precisely the moment it is most needed.”

Additionally, Google argues that splitting off Chrome could:

- Increase device costs.

- Undermine Google's competition with Apple’s iOS ecosystem.

- Make it harder to ensure browser security.

Photo via The Verge // Competitors like Safari and Firefox could gain significant market share if Chrome is spun off.

Photo via The Verge // Competitors like Safari and Firefox could gain significant market share if Chrome is spun off.

The Bigger Picture

Judge Mehta has underscored the importance of default search deals in sustaining Google’s dominance. In his August ruling, he described default search engine agreements as “extremely valuable real estate,” highlighting that rivals would need to pay billions to compete.

This case is part of a broader crackdown on Big Tech. If the DOJ succeeds, it would signal a monumental shift in how antitrust laws are applied to the tech industry, potentially setting precedents for other giants like Amazon, Meta (Facebook/Instagram/WhatsApp), and Apple Inc.

What’s Next?

The DOJ and state attorneys are set to make their final recommendations this week, with a two-week hearing on remedies scheduled for April 2025. A final ruling in the trial is expected in August 2025.

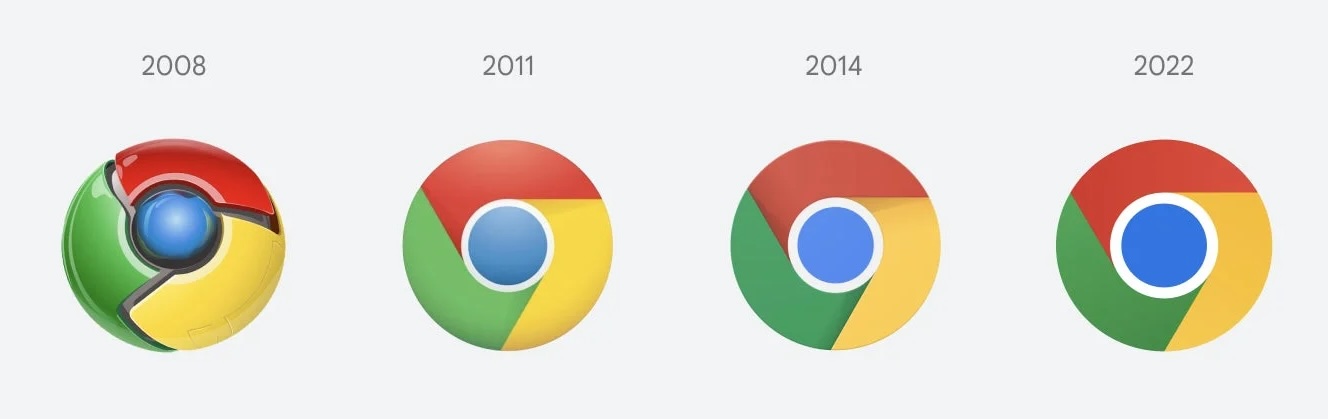

While the DOJ pushes for drastic measures, some experts caution against overreach. Adam Kovacevich, CEO of the Chamber of Progress, warned that extreme remedies like a Chrome divestiture could weaken the case on appeal, comparing it to the DOJ's overreach in the 2001 Microsoft case. Photo via Gizmodo // The history of the Google Chrome logo: from 2008 to 2022.

Photo via Gizmodo // The history of the Google Chrome logo: from 2008 to 2022.

The Stakes for Google

With its search and advertising revenue rising 10% year-over-year to $65.9 billion in the last quarter, Google’s financial strength remains intact. CEO Sundar Pichai has touted the company’s advancements in AI-powered search tools, which are now accessible to millions of users. However, the uncertainty surrounding potential divestitures has put pressure on Alphabet’s stock, as investors brace for significant changes.

The outcome of this case will not only shape Google’s future but also redefine the limits of antitrust enforcement in the digital age.

No password required

A confirmation request will be delivered to the email address you provide. Once confirmed, your comment will be published. It's as simple as two clicks.

Your email address will not be published publicly. Additionally, we will not send you marketing emails unless you opt-in.