Apple is expected to post its first revenue decline since 2019 this week

- Apple is expected to report its first YoY revenue decline since 2019.

- The company's financials have been impacted by production issues and the pandemic's effect on the smartphone and PC markets.

- Despite headwinds, many investors believe Apple is outperforming its competitors.

- Apple's March quarter revenue is expected to decline at a less-than-seasonal rate.

- Consumer confidence, Apple's services business, and the strong dollar will be watched closely.

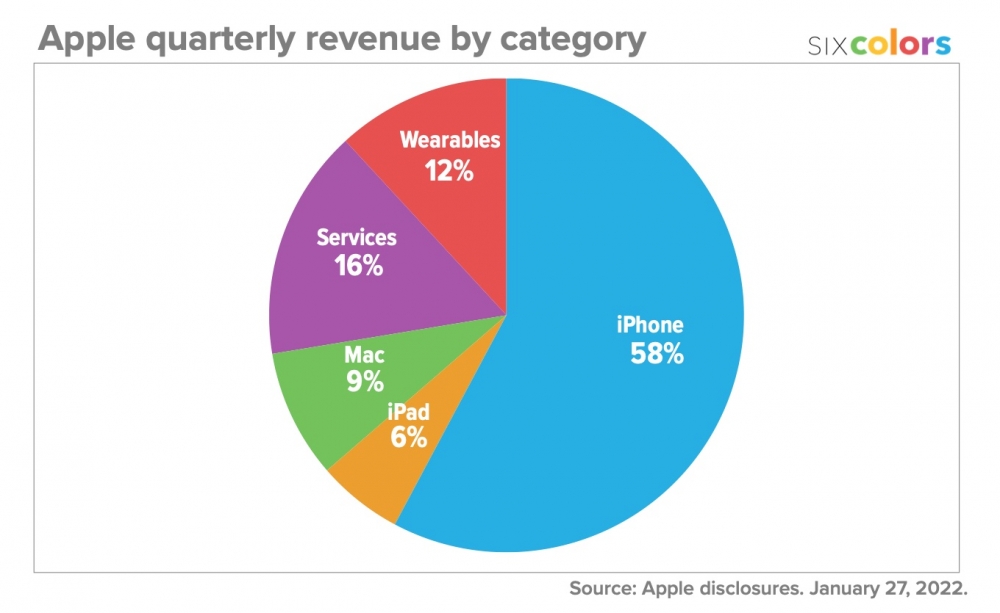

Apple is set to report its first year-over-year revenue decline since the March quarter of 2019 when it releases its earnings on Thursday. The smartphone giant is expected to report revenue of $121.19 billion and earnings per share of $1.94, according to Refinitiv consensus estimates. iPhone revenue is estimated to come in at $68.29 billion, iPad revenue at $7.76 billion, Mac revenue at $9.63 billion, other products revenue at $15.26 billion, and services revenue at $20.67 billion.

The company's financials have been impacted by a series of factors, including production issues that arose when its primary assembly facility in China was shut down for several weeks during Covid lockdowns. This led to a shortage of high-end iPhones and wait times of 34 days in the US and 36 days in China. The pandemic has also caused a slump in both the smartphone and PC markets, with the former seeing an 18% decline in shipments and the latter a 28% decline, according to IDC.

Despite these headwinds, many investors believe that Apple is outperforming its competitors, with the company's underlying drivers, such as its growing installed base and spend per user, still intact. Additionally, the strength and stability of the company's ecosystem remain undervalued, according to Morgan Stanley analyst Erik Woodring.

Despite these headwinds, many investors believe that Apple is outperforming its competitors, with the company's underlying drivers, such as its growing installed base and spend per user, still intact. Additionally, the strength and stability of the company's ecosystem remain undervalued, according to Morgan Stanley analyst Erik Woodring.

If consumer confidence erodes due to higher interest rates and shrinking savings, it could suggest that the company's March quarter will be slow. Investors will also be paying close attention to Apple's services business, which has been growing strongly in recent years and is expected to come in at $20.67 billion in the December quarter, representing a 5.9% growth rate. Finally, analysts will be watching to see if the strong dollar continues to hurt Apple, given that much of its sales are overseas, with the company previously stating that the strong dollar would be a 10 percentage point drag on sales growth.

Recommended by the editors:

Thank you for visiting Apple Scoop! As a dedicated independent news organization, we strive to deliver the latest updates and in-depth journalism on everything Apple. Have insights or thoughts to share? Drop a comment below—our team actively engages with and responds to our community. Return to the home page.Published to Apple Scoop on 31st January, 2023.

No password required

A confirmation request will be delivered to the email address you provide. Once confirmed, your comment will be published. It's as simple as two clicks.

Your email address will not be published publicly. Additionally, we will not send you marketing emails unless you opt-in.