Are iPhone Sales Actually Declining?

- Third-party data reveals a fragmented picture of the iPhones sales trends.

- iPhone sales dropped over 10% globally—but what's fueling the decline?

- Discover the hidden factors impacting Apple’s latest iPhone performance.

Apple Inc. stands at a pivotal moment as its iPhone sales reveal a complex and mixed trajectory across global markets. While certain regions witness a downturn, others show promising growth, painting a nuanced picture of the tech giant's performance. It’s important to note that Apple ceased publicly reporting detailed iPhone sales figures after 2019, so the insights available today are pieced together from third-party analyses, offering a glimpse rather than a comprehensive view of the company's sales dynamics. Photo via Backlinko // Graph: Worldwide iPhone users continues to increase year after year, due to a thriving second-hand market for used iPhones, as well as more budget-friendly options from Apple (2008-2023).

Photo via Backlinko // Graph: Worldwide iPhone users continues to increase year after year, due to a thriving second-hand market for used iPhones, as well as more budget-friendly options from Apple (2008-2023).

Global Sales Overview: Early 2024 Decline

In the first quarter of 2024, Apple reported a more than 10% decline in iPhone sales globally, excluding Europe where demand remained robust. This slump contributed to a 4% drop in total revenue, bringing the figure down to $90.8 billion (£72.5 billion) for the quarter ending March 31. Despite this downturn, Apple's stock price demonstrated resilience, increasing during New York after-hours trading.

Tim Cook, Apple’s CEO, addressed the decline during a conference call, attributing it to supply chain disruptions caused by COVID-19. "The figures were inflated last year due to exceptionally high sales," Cook explained. He remained optimistic, highlighting upcoming product launches and investments in artificial intelligence (AI) as potential catalysts for future growth. Photo via Tech Xplore // Apple CEO Tim Cook laughs and smiles with guests at the yearly iPhone Apple Event earlier this year, where the tech giant unveiled iPhone 16, 16 Plus, 16 Pro and 16 Pro Max.

Photo via Tech Xplore // Apple CEO Tim Cook laughs and smiles with guests at the yearly iPhone Apple Event earlier this year, where the tech giant unveiled iPhone 16, 16 Plus, 16 Pro and 16 Pro Max.

Regional Performance: Diverging Paths

China: Facing Intense Competition

China remains a challenging market for Apple. During the two-week Singles’ Day sales period, iPhone sales in China declined by 9% year-on-year (YoY), according to Counterpoint Research. Local brands like Huawei have intensified competition, leveraging their status as homegrown brands to capture market share.

Gil Luria, senior software analyst at DA Davidson, highlighted on BBC’s Today program, “But in terms of features, functionality, and prestige, iPhone still has an advantage over any other handset.” Nevertheless, consumer preference is increasingly shifting towards domestic alternatives.

Ivan Lam, Senior Analyst at Counterpoint Research, added, “With the increasing emphasis on premiumisation and rationalisation of consumption, sales of entry-to-mid models are declining, leading OEMs to shift their focus away from these segments and toward boosting sales of flagship models.”

India: A Beacon of Growth

Contrastingly, India presents a bright spot for Apple. The launch of the iPhone 16 ahead of the festive season has spurred significant sales growth. Prachir Singh, Senior Research Analyst at Counterpoint, noted, “Apple has aggressively expanded into smaller cities, driving significant value growth with an increased focus on newer iPhones.” This strategic expansion has allowed Apple to tap into the rising smartphone adoption rates in India, positioning the country as a key growth market.

Signs of Recovery in Q4

Despite the earlier decline in Q1, Apple's most recent quarterly report shows a 6% increase in total revenue, reaching $94.9 billion, slightly surpassing Wall Street expectations of $94.6 billion. Notably, iPhone sales rebounded by 5.4% to $46.2 billion, reversing two consecutive quarters of decline. This resurgence was bolstered by the introduction of the iPhone 16, which launched towards the end of the quarter.

Tim Cook shared during a conference call, “iPhone sales set a September revenue record, with growth in every geographic segment.” However, Apple’s net income saw a 35% decrease to $14.7 billion, impacted by a one-time tax charge related to the European General Court’s State Aid decision.

Fourth quarter results summary:

- iPhone: Sales increased by 5.4% to $46.2 billion, reversing two consecutive quarters of decline.

- Mac Computers: Grew by 1.3% to $7.7 billion.

- iPads: Saw robust growth of 7.8% to $6.9 billion.

- Wearables, Home, and Accessories: Declined by 3% to $9 billion.

Photo via CNET France // The Apple iPhone 16 in 'Ultramarine', a mix of blue and purple.

Photo via CNET France // The Apple iPhone 16 in 'Ultramarine', a mix of blue and purple.

US Market: Mixed Signals

In the United States, the initial sales of the iPhone 16 series are slightly trailing last year’s iPhone 15, with a -1% YoY decline through the first four weeks of availability, as reported by Counterpoint’s Weekly Sell-Through Tracker. Maurice Klaehne, Senior Analyst at Counterpoint, observed, “US wireless carriers continue to report weak smartphone upgrade rates, indicating that buyers have not seen reasons to change their behavior of holding on to their existing smartphones for longer periods of time – yet.”

Despite this slight decline, Apple’s overall quarterly revenue increased, suggesting that other product lines are compensating for the modest dip in iPhone sales in the US.

US wireless carriers continue to report weak smartphone upgrade rates, indicating that buyers have not seen reasons to change their behavior of holding on to their existing smartphones for longer periods of time – yet. Maurice Klaehne.

Looking Ahead: AI and Strategic Initiatives

Apple is heavily investing in its AI strategy to rejuvenate iPhone sales. The integration of Apple Intelligence across its latest operating systems offers features like professional email rewriting, primarily available on the iPhone 16 models. However, some AI features have been delayed, potentially slowing down consumer upgrades. And not everyone has been impressed with Apple's latest AI features.

Tim Cook emphasized, “We’re doing it because we can provide the same standard of privacy and security that we can provide on device.” This focus on privacy and security aims to differentiate Apple from competitors like Microsoft and Meta, who are also ramping up their AI investments.

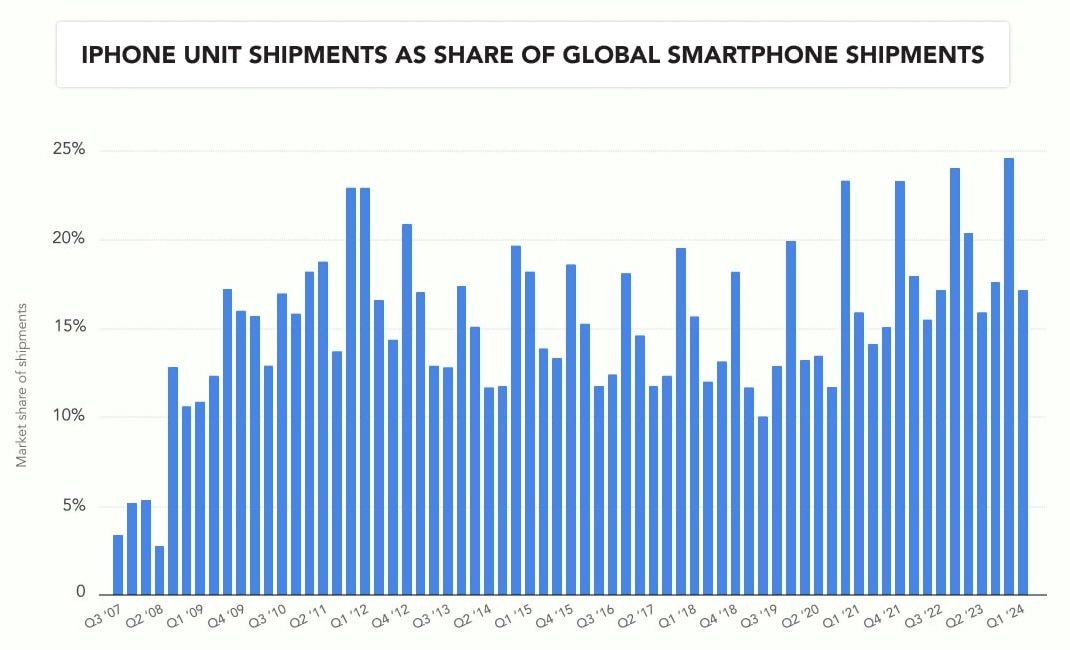

Photo via GrabOn // Graph: iPhone unit shipments as percentage share of global smartphone shipments.

Photo via GrabOn // Graph: iPhone unit shipments as percentage share of global smartphone shipments.

Conclusion: A Complex Landscape

Apple's iPhone sales trajectory presents a mixed picture. While the first quarter saw a significant decline globally, recent quarters indicate a rebound in sales, particularly driven by new product launches and strategic expansions in markets like India. However, challenges remain in key markets such as China and the US, where local competition and weak upgrade rates pose ongoing threats.

The reliance on third-party data since Apple stopped reporting detailed iPhone sales post-2019 means that these figures offer only a partial view of the company's performance. Moving forward, Apple's ability to sustain growth will hinge on its ability to continue innovating. As Apple ventures deeper into AI and other emerging technologies, the coming quarters will be critical in determining whether the current sales dip is a temporary setback or part of a broader trend.

Recommended by the editors:

Thank you for visiting Apple Scoop! As a dedicated independent news organization, we strive to deliver the latest updates and in-depth journalism on everything Apple. Have insights or thoughts to share? Drop a comment below—our team actively engages with and responds to our community. Return to the home page.Published to Apple Scoop on 25th November, 2024.

No password required

A confirmation request will be delivered to the email address you provide. Once confirmed, your comment will be published. It's as simple as two clicks.

Your email address will not be published publicly. Additionally, we will not send you marketing emails unless you opt-in.