Trump Tariffs: Could Your Next iPhone Suddenly Cost More?

- Apple's prices could soon climb—but maybe not as steeply as you’d think.

- Trump’s tariffs just got doubled, and your wallet might feel the pinch.

- Should you rush to buy your iPhone now? The answer might surprise you.

The latest round of tariffs imposed by President Donald Trump could soon translate to higher prices for your favorite Apple products. With Trump’s recent announcement of an additional 10% tariff on Chinese imports, cumulative tariffs on certain goods have now hit 20%, raising questions on how Apple—and its customers—might be affected.

Understanding the Tariffs: What's New?

This isn't Trump's first move on tariffs. He previously enacted a 10% tariff on Chinese imports in early February, adding another 10% recently, which effectively doubles the tariffs on many Chinese-manufactured products. His aim? To reduce trade imbalances, encourage domestic manufacturing, and boost U.S. employment numbers. Trump has said openly he's prepared to accept some short-term economic disruptions, believing it’ll pay off in the long run: “There’ll be a little disturbance. But we’re OK with that. It won’t be much.”

China quickly responded with reciprocal tariffs targeting American goods, particularly agriculture and energy products such as soybeans, beef, coal, and oil. These tit-for-tat measures have triggered concerns among economists about inflationary pressures and potential job losses in the long term.

Critics, meanwhile, remain skeptical about the long-term effectiveness of Trump's tariff strategy. While there was a temporary gain of around 5,000 manufacturing jobs back in 2018 following the initial round of tariffs, studies later estimated a net loss of about 75,000 jobs.

Will Apple Raise Prices?

Given Apple's extensive manufacturing operations in China—especially for flagship products like the iPhone, iPad, MacBook, and AirPods—experts anticipate some price hikes are inevitable. But exactly how high?

Stephan Shipe, CEO of Scholar Financial Advising, suggests prices could jump between 5% and 10% in the coming months:

Apple has traditionally absorbed most tariff impacts, but the company would likely need to pass a portion of these costs to consumers.— Stephan Shipe, CEO of Scholar Financial Advising

However, a direct 20% price surge seems unlikely. Companies often shoulder some of the increased costs themselves to stay competitive. For example, the current base price of the iPhone 16 at T-Mobile is around $830; if fully passed on to the consumer, that could rise significantly—up to nearly $996. Similarly, the MacBook Air’s base price of $1,099 could climb toward $1,318.

Patti Brennan, CEO of Key Financial, offered perspective:

Apple has positive earnings to absorb the higher prices on many of its products, but not all. Apple’s most important product is the iPhone. Readers should expect price increases either directly or indirectly… How much remains to be seen.— Patti Brennan, CEO of Key Financial

Interestingly, Apple recently announced a $100 price cut on its latest MacBook Air model just as tariffs took effect—perhaps signaling their willingness to absorb short-term hits to stay attractive to consumers.

Photo via ABC News // U.S. 47th President Donald J. Trump alongside the leaders of Canada (now former), China, and Mexico, targets of Trumps recent tariffs.

Photo via ABC News // U.S. 47th President Donald J. Trump alongside the leaders of Canada (now former), China, and Mexico, targets of Trumps recent tariffs.

Should Consumers Buy Now?

Retail giants Best Buy and Target have already signaled to consumers that higher prices across electronic goods could soon follow. Acer, too, recently hiked laptop prices due to prior tariffs.

If you're considering an upgrade soon, does it make sense to buy now and dodge future price hikes? Financial experts suggest caution. Shipe believes immediate panic-buying may not be necessary unless you genuinely need the product soon:

We'd only expect an increase of $50 to $150 on the top end of the Apple product line.— Shawn DuBravac, IPC

Moreover, economists argue that patience might actually pay off:

Technology is naturally deflationary, meaning that over time performance goes up and prices generally go down for products of similar quality.— Shawn DuBravac, IPC

In other words, unless you're urgently needing a new device, rushing might not be necessary.

Why Apple Chooses China

Apple CEO Tim Cook has long argued against tariffs on China-made tech products, not only because of costs but also due to skilled labor availability in China:

There's a confusion about China. The popular conception is that companies come to China because of low labor costs. The truth is, China stopped being a low-labor-cost country many years ago… The reason is because of skill.— Tim Cook, in a recently resurfaced video from 2018

Apple's Tim Cook emphasizes the immense scale and specialized tooling expertise available in China—resources that he believes simply aren’t available at the same magnitude in the United States:

In the U.S., you could have a meeting of tooling engineers, and I'm not sure we could fill the room. In China, you could fill multiple football fields.— Tim Cook

Apple’s $500 Billion Bet

Apple has promised massive investment in U.S. manufacturing over the next four years—pledging to spend $500 billion and create 20,000 American jobs, including a high-profile A.I. server factory in Houston. Industry watchers, including Gene Munster from Deepwater Asset Management, suggest this significant commitment could be part of Apple’s strategy to win tariff exemptions.

Trump made it clear: You have to show me some love [...] and the answer is they would rather spend this money themselves on infrastructure than give it to Uncle Sam.Gene Munster, Deepwater Asset Management

This isn’t the first time Apple has leveraged investment commitments for tariff relief. Historically, they've managed to avoid levies on key products like the Apple Watch by negotiating directly with Trump's administration.

What Analysts Say

Bank of America analysts suggest Apple would need to raise prices around 9% to fully offset Trump's latest tariffs. If Apple absorbs the cost instead, the firm estimates it could face about a 3% earnings hit in 2026. Analyst Wamsi Mohan describes the potential tariff burden as "manageable," though he admits the full impact depends heavily on consumer behavior and market dynamics.

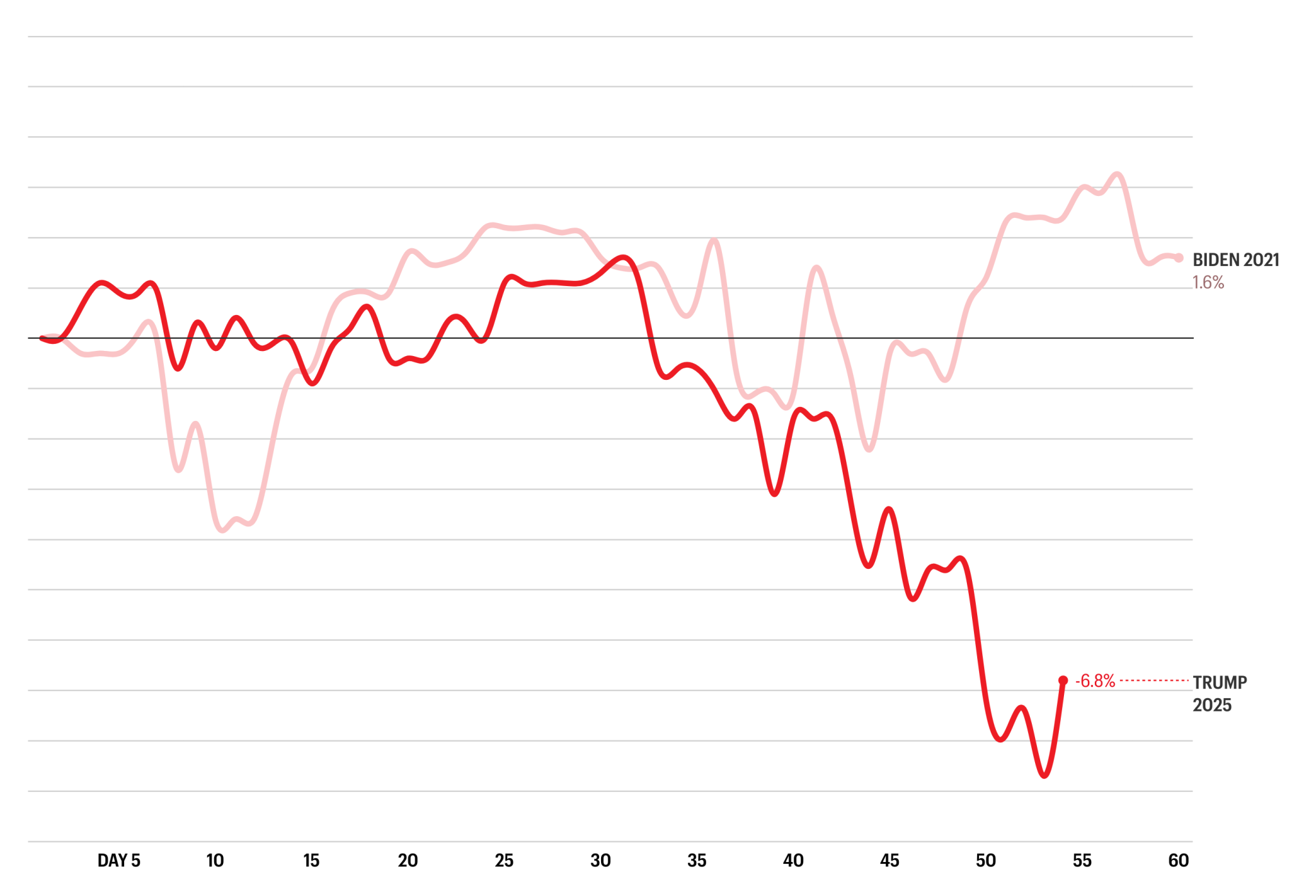

Photo via Inkl // A graph comparing the stock markets performance during the first roughly 60 days of new leadership in the White House (Biden and Trump).

Photo via Inkl // A graph comparing the stock markets performance during the first roughly 60 days of new leadership in the White House (Biden and Trump).

A Neutral Outlook

Despite Trump’s insistence that tariffs protect U.S. jobs, the broader economic outlook remains uncertain. Higher consumer prices, retaliatory tariffs from trade partners, and slower consumer spending could challenge growth for companies reliant on discretionary spending—Apple included.

In the past, Apple’s stock has shown resilience during downturns, recovering quickly after significant market dips like those during COVID or inflation shocks. However, a sustained trade war scenario presents unique challenges.

Currently trading at a premium—about 34 times expected FY2025 earnings—Apple stock might not withstand sustained economic pressures without significant volatility.

Bottom Line

All things considered, it seems likely that Trump’s tariffs will eventually filter through to consumer wallets, but perhaps not as dramatically as some might fear. Apple’s historical willingness to absorb certain costs, its recent investment promises, and consumer sensitivity could temper the actual retail price increases we see.

In the end, whether Apple customers see significant price hikes depends largely on how long tariffs last, how effectively Apple lobbies for exemptions, and how deeply the company itself chooses—or is able—to absorb the cost. Consumers, meanwhile, may have to brace themselves for some higher prices or consider delaying upgrades as market dynamics unfold.

Recommended by the editors:

Thank you for visiting Apple Scoop! As a dedicated independent news organization, we strive to deliver the latest updates and in-depth journalism on everything Apple. Have insights or thoughts to share? Drop a comment below—our team actively engages with and responds to our community. Return to the home page.Published to Apple Scoop on 18th March, 2025.

No password required

A confirmation request will be delivered to the email address you provide. Once confirmed, your comment will be published. It's as simple as two clicks.

Your email address will not be published publicly. Additionally, we will not send you marketing emails unless you opt-in.