How Does Apple Avoid Paying Billions in Taxes? Inside Ireland’s Secret Deal

- Apple found a way to cut its tax bill to almost zero—and it's not illegal.

- A single court case could cost Apple $14.4 billion in back taxes.

- Ireland and Apple have been fighting the EU for years over tax deals—here's how it all went down.

When it comes to the world of tech giants, Apple has long stood as a leader—not just in innovation, but in its ability to minimize its tax payments. The company’s tax practices, particularly its arrangement with Ireland, have enabled Apple to avoid paying billions in taxes, sparking controversy across the globe.

In this investigation, we explore how Apple maneuvers through international tax systems, using complex structures and favorable jurisdictions to significantly reduce its tax burden.

Apple and the "Double Irish" Strategy

Apple’s use of a tax structure known as the “Double Irish” was instrumental in its ability to lower taxes on billions of dollars in profits. The scheme allowed Apple to transfer profits to subsidiaries in Ireland, where they were then funneled through a Dutch intermediary and back to another Irish entity. This technique was famously dubbed the “Double Irish with a Dutch Sandwich.”

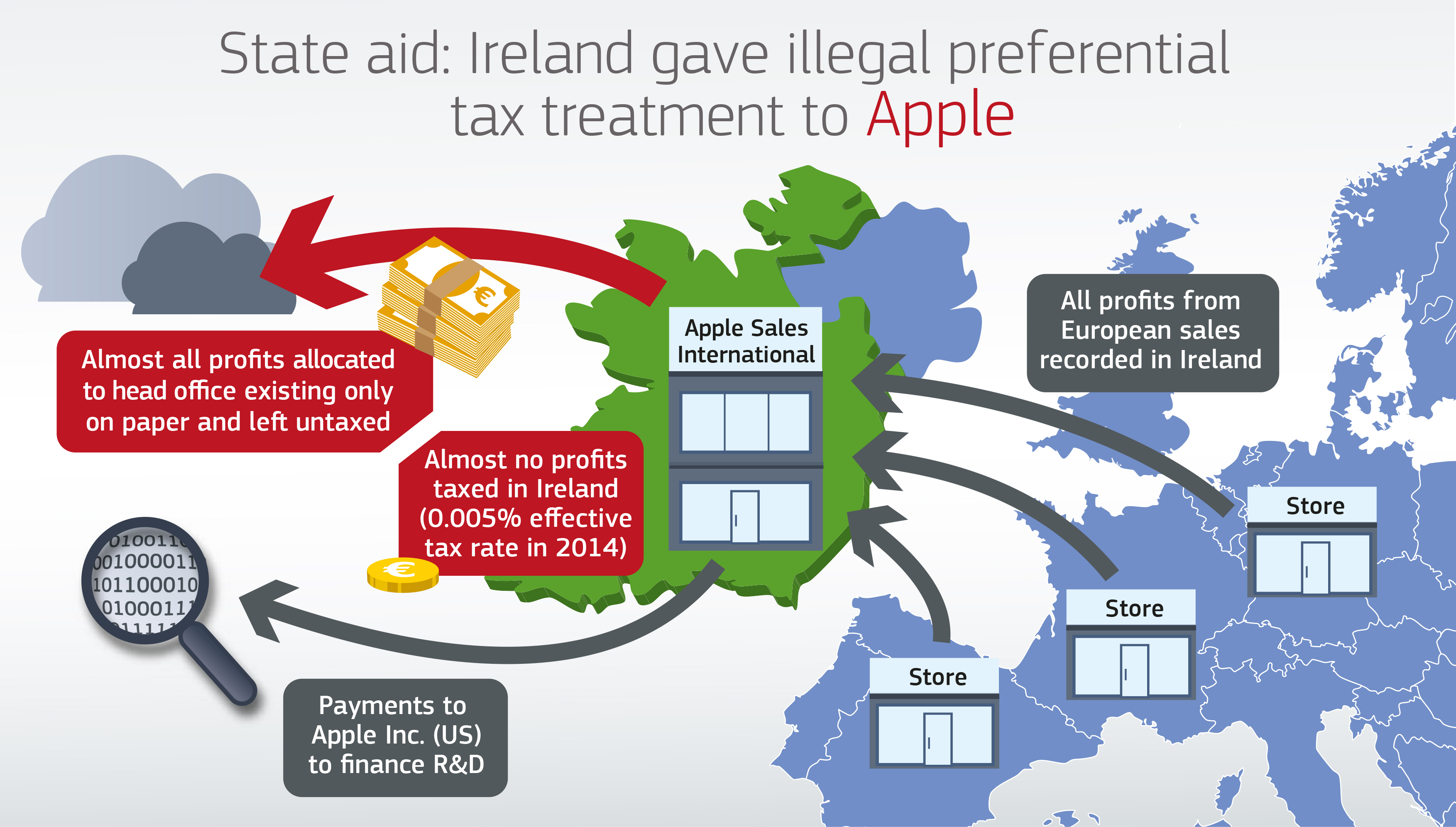

Under this system, Apple’s Irish subsidiaries paid an extremely low tax rate. In fact, according to an EU investigation, Apple’s effective tax rate in Ireland dropped as low as 0.005%. By comparison, U.S. corporate tax rates stood at 40%, while Ireland's standard corporate tax rate was already much lower at 12.5%. Photo via Wikipedia // Here's how Apple's Irish tax scheme works.

Photo via Wikipedia // Here's how Apple's Irish tax scheme works.

A Closer Look at Ireland's Tax Loopholes

For decades, Ireland attracted multinational corporations, like Apple, with its lenient tax laws. This has turned Ireland into a magnet for U.S. firms, with 90% of Fortune 500 companies setting up operations in the country. As a result, Ireland has become home to over 700 U.S. companies, contributing significantly to its economic growth.

Despite closing the Double Irish loophole in 2014 under pressure from both the EU and the U.S., Apple and similar companies continued to benefit from other advantageous tax practices for years.

Apple’s $14.4 Billion Tax Bill: The EU’s Crackdown

In 2016, the European Commission’s competition chief, Margrethe Vestager, made headlines when she accused Ireland of granting illegal tax benefits to Apple. The commission concluded that Apple owed €13 billion (roughly $14.4 billion) in back taxes to the Irish government due to these sweetheart deals. Photo via Quicko // Apple's billion dollar tax tug of war with Ireland and the EU.

Photo via Quicko // Apple's billion dollar tax tug of war with Ireland and the EU.

The Legal Battle

Both Apple and Ireland contested the ruling, leading to a protracted legal battle. Apple claimed it had followed the rules and paid all the taxes it owed. The Irish government, keen to keep Apple—the largest private-sector employer in Cork—defended its tax practices, arguing that it hadn’t offered any special treatment.

However, the European Court of Justice ultimately sided with the European Commission. The ruling stated that Apple had indeed benefited from unfair loopholes in Ireland’s tax regime and ordered the company to pay back taxes.

Apple’s statement following the court's decision expressed disappointment, claiming:

The European Commission is trying to retroactively change the rules and ignore that, as required by international tax law, our income was already subject to taxes in the U.S.

The company has since paid the €14.3 billion in back taxes and interest into an escrow fund, although the case continues to drag on, with Apple appealing the decision to the Court of Justice of the European Union.

Why Ireland Defended Apple

Many might wonder why Ireland, which stood to gain billions, fought so hard to defend Apple. For the Irish government, the stakes went beyond this one case. Ireland has long relied on its corporate tax policies to attract foreign direct investment (FDI), which has driven much of the country’s economic growth.

According to Michael Lohan, head of Ireland’s Investment Development Authority (IDA), the ruling did not damage Ireland’s reputation for attracting FDI. However, others argue that Ireland’s reputation took a hit, especially considering the stark inequality between large corporations and average taxpayers.

While Apple continues to flourish in Ireland, the case has raised broader questions about the role of low-tax jurisdictions in the global economy. Critics argue that countries like Ireland fuel a “race to the bottom” in corporate taxation, with severe implications for global tax fairness. Photo via ACS // This is the story of how Apple avoids paying billions of dollars in taxes using totally legal, albeit morally questionable, tax schemes.

Photo via ACS // This is the story of how Apple avoids paying billions of dollars in taxes using totally legal, albeit morally questionable, tax schemes.

Implications for Global Tax Policy

The Apple case is a landmark in the broader push for tax reform. Margrethe Vestager, who has spearheaded the EU’s crackdown on tax avoidance, described the ruling as:

A HUGE win for tax justice and social fairness.

This case is not an isolated incident, but part of a larger movement to close loopholes that allow multinational corporations to avoid paying their fair share. The OECD’s Base Erosion and Profit Shifting (BEPS) initiative aims to ensure that profits are taxed where economic activities take place. Ireland, after years of benefiting from its favorable tax policies, has now signed onto the OECD’s plan, which includes a global minimum corporate tax rate of 15%.

Conclusion: The Future of Corporate Taxation

Apple's tax practices highlight a larger issue in the world of multinational corporations and international taxation. While legal, these practices are now being challenged on a global scale. As the European Union and other bodies continue their efforts to reform corporate tax laws, Apple’s experience in Ireland serves as a cautionary tale for other corporations relying on similar strategies.

As Apple appeals the ruling, the case remains a critical moment in the fight for global tax fairness, raising questions about the balance between attracting investment and ensuring corporations contribute their fair share.

Recommended by the editors:

Thank you for visiting Apple Scoop! As a dedicated independent news organization, we strive to deliver the latest updates and in-depth journalism on everything Apple. Have insights or thoughts to share? Drop a comment below—our team actively engages with and responds to our community. Return to the home page.Published to Apple Scoop on 8th October, 2024.

No password required

A confirmation request will be delivered to the email address you provide. Once confirmed, your comment will be published. It's as simple as two clicks.

Your email address will not be published publicly. Additionally, we will not send you marketing emails unless you opt-in.